You can achieve financial stability without a budget; it’s like assembling DIY furniture without the instructions. It takes 10 times as long, leads to fights with your significant other and never looks like the picture on the box. And, almost everyone attempts to do both at least once during their lifetime.

Sure, there’s a challenge in puzzling out the 50 pieces of a bed frame, but there’s a lot more at stake with your money. Increase your chances of success by following the directions and keeping it simple.

1. Essential Expenses

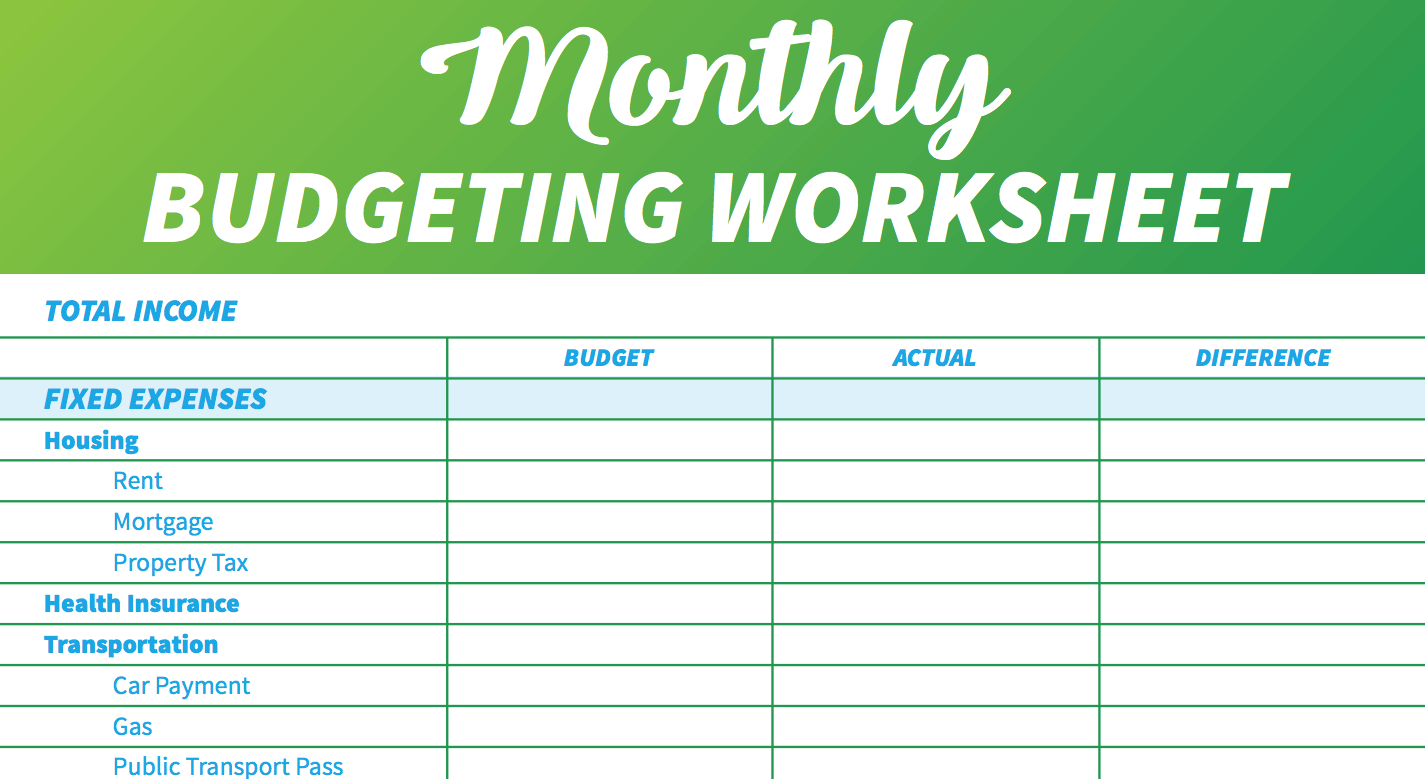

First, determine your total monthly in-pocket income. Leave out taxes and business outlays, but include automatic payments such as employer insurance or 401(k) deductions for an accurate picture of your expenses. Now, budget up to one-half of that total for essential expenses, including housing, basic utilities, groceries, healthcare, auto insurance Newark DE and child costs.

The twentieth annual Peoria Automotive Show, held April three-5 this 12 months at the Peoira Civic Center in downtown Peoria, Illinois, featured 37 Peoria automobile sellers displaying more than 300 vehicles on the Peoria Civic Center. Chicago customers can convey your automobile in for routine upkeep to Al Piemonte Buick GMC’s Elmhurst service heart. Our customers will find all the pieces they need for their vehicle. Located close to Chicago, our Elmhurst Buick and GMC service middle and excellent GM tire store have the assets to be your one-cease location for maintenance. Contact our technicians right now with any questions about your car needs! Al Piemonte Buick GMC might help any clients looking for a car, body shop, or GM service heart.

The twentieth annual Peoria Automotive Show, held April three-5 this 12 months at the Peoira Civic Center in downtown Peoria, Illinois, featured 37 Peoria automobile sellers displaying more than 300 vehicles on the Peoria Civic Center. Chicago customers can convey your automobile in for routine upkeep to Al Piemonte Buick GMC’s Elmhurst service heart. Our customers will find all the pieces they need for their vehicle. Located close to Chicago, our Elmhurst Buick and GMC service middle and excellent GM tire store have the assets to be your one-cease location for maintenance. Contact our technicians right now with any questions about your car needs! Al Piemonte Buick GMC might help any clients looking for a car, body shop, or GM service heart.