You can achieve financial stability without a budget; it’s like assembling DIY furniture without the instructions. It takes 10 times as long, leads to fights with your significant other and never looks like the picture on the box. And, almost everyone attempts to do both at least once during their lifetime.

Sure, there’s a challenge in puzzling out the 50 pieces of a bed frame, but there’s a lot more at stake with your money. Increase your chances of success by following the directions and keeping it simple.

1. Essential Expenses

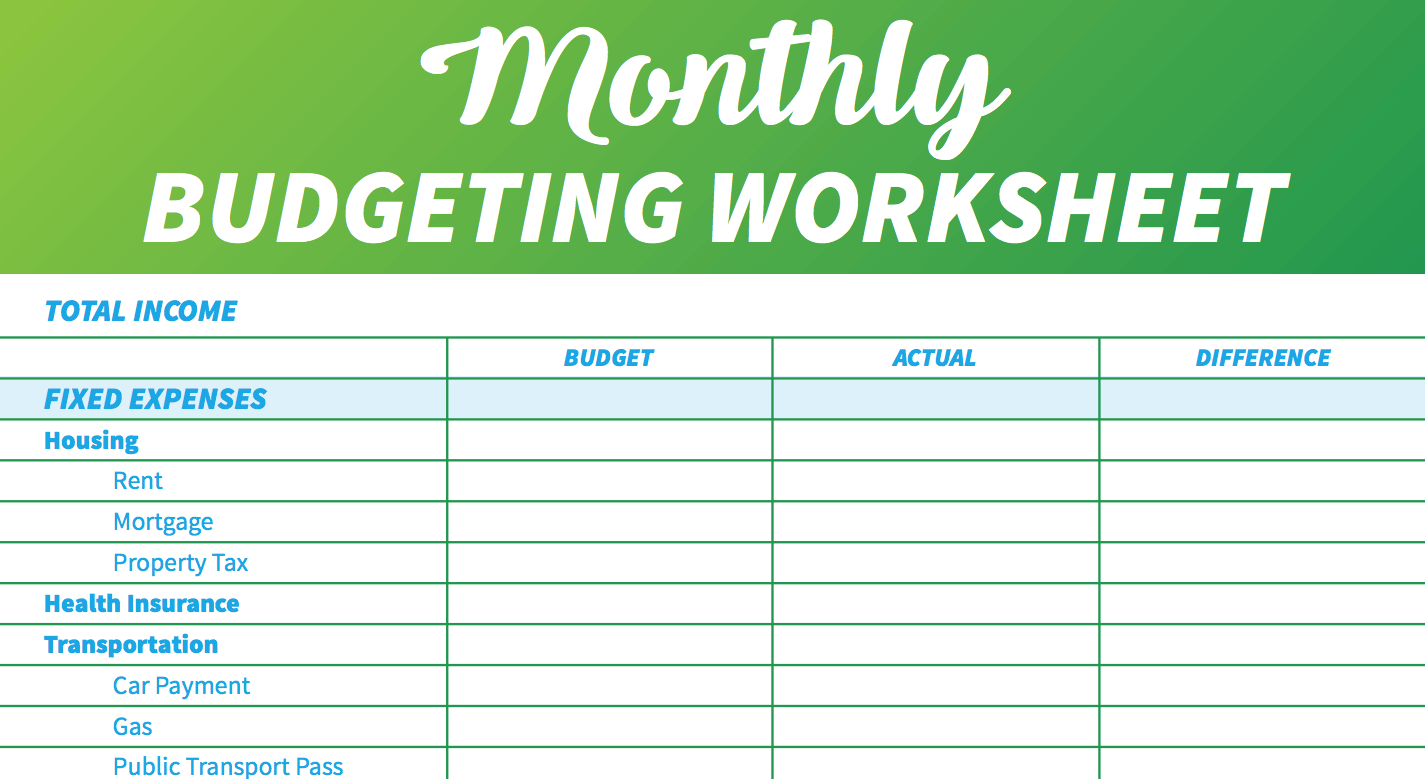

First, determine your total monthly in-pocket income. Leave out taxes and business outlays, but include automatic payments such as employer insurance or 401(k) deductions for an accurate picture of your expenses. Now, budget up to one-half of that total for essential expenses, including housing, basic utilities, groceries, healthcare, auto insurance Newark DE and child costs.

2. Lifestyle Expenses

After you meet your living costs, give yourself an allowance of no more than one-third of your total income for enjoyment and creature comforts. Determining whether an expense is necessary or discretionary, however, might look different for each individual. For example, classes at a community college might be necessary for a CPA, but elective for a landscaper with a penchant for knowledge.

3. Savings and Debt Repayment

Finally, allocate at least one-fifth — more, if you didn’t max out your essential and lifestyle expense budgets — to build your savings and repay any debt obligations. The specifics depend on your finances and debts, but you can form your plan based on this generally accepted hierarchy:

- Save for emergencies

- Match employer 401(k) contributions

- Pay off unsecured debts with the highest rate

- Boost your retirement savings

- Boost your emergency savings

- Increase remaining loan payments

Of course, finishing the planning stage is often where the simple part ends. You might need hard-core discipline to stick to your budget, especially if you need to adjust your lifestyle or spending patterns. Like any other good habit, the more you practice, the easier it gets, and financial peace of mind is way better than an exquisitely assembled bed frame.